Pros and Cons of Trading Cryptocurrency Today

Over the last few years, trading in cryptocurrency has gained traction as a tremendously lucrative activity. Digital coins such as Bitcoin, Ethereum and Litecoin have risen in popularity quite dramatically.

Trading in digital currencies has even received mainstream support from billionaires and technology influencers. As a matter of fact, many billionaires around the world have invested in cryptocurrency. Examples of these are:

Chris Larsen- Angel Investor worth $2.1 billion USD

Changpeng Zhao – founder and CEO of Binance worth $1.4 billion USD

Winklevoss twins- Entrepreneurs worth worth $1.4 billion USD

Digital currency has also received ample support from banks and financial institutions. Examples of these are:

Goldman Sachs

Ally Bank

USAA

This shows that cryptocurrencies are gaining ample support from the mainstream. In this way, they are being accepted as reliable stores of value. This makes them ideal instruments of investment.

Before you jump into the cryptocurrency trading deep end, you need to weigh your options. Here are the pros and cons of cryptocurrency trading.

Advantages of trading in cryptocurrencies

- Freedom

Digital currencies were created specifically to deliver transactional freedom. You can send cryptocurrency to anyone around the world without worrying about fees, cross-border restrictions, holidays or amount limitation. Digital currencies are also fully decentralized. This means that there is no single person in charge. As a result, you are in full control of your money.

- Ample marketplaces

Today, it is very easy to begin trading and investing in cryptocurrencies. This is because there are hundreds of live exchanges on the Internet. Many of them allow you to open an account for free. Moreover, they even have software which can match your bid to a suitable ask. Thanks to this, you can trade and invest confidently with maximum convenience. Best of all, these exchanges provide you with a collection of different methods of cashing out your digital currencies.

- Transparency

Every single cryptocurrency transaction is recorded in a Distributed Ledger. This is a major advantage of the Blockchain. Every computer which gains access to the Blockchain receives a living copy of the Distributed Ledger. This report is updated regularly. Hence, you can view the latest transactions as they happen.

Your wallet address is indicated in the Distributed Ledger. However, your personal details are kept secret. This ledger cannot be edited by anyone. Also, it cannot be manipulated by any organization, government or company. It ensures maximum transparency while maintaining total anonymity.

- Security

Whenever you are investing your money, security is always a major concern. Thankfully, cryptocurrencies provide bullet proof security options. As you trade and invest in cryptocurrencies, you can store the digital coins in special software wallets. They implement 256 bit encryption and can be fitted with 2-factor authentication. This way, your digital currency is safely stored in the software wallet. You can even back up your cryptocurrency in encrypted, offline hardware units. This is usually referred to as cold storage.

- Protection

When you are trading in cryptocurrencies, you are also protected from predatory trading techniques. For example, a broker may want to charge you an exorbitant fee to process your buy or sell order. Seeing as every transaction is recorded in the Distributed Ledger, they cannot overcharge you and go unnoticed by other customers. Therefore, they have to communicate any additions or increment in charges before levying them to you.

- Low transaction fees

A great feature of trading in cryptocurrencies is that you get to enjoy very low fees. Whenever you buy or sell digital coins, the fees charged are very low compared to the value of the cryptocurrency involved. Moreover, the exchanges use fees as a competitive platform to entice new traders. As such, you are most likely to find that many exchanges around the world charge very low fees for you to trade. As a rule of thumb, some transactions may have higher charges. However, such transactions are often given a higher priority in the Blockchain network. Hence, they are fulfilled quicker.

Disadvantages of trading in cryptocurrencies

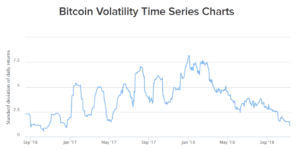

- Volatility

This is the biggest disadvantage of trading in cryptocurrencies. They are prone to volatility. A cryptocurrency can be worth a fortune today and be utterly worthless tomorrow. Experienced, skilled traders can use volatility to their advantage. However, it requires sharp, quick responses to market conditions for you to profit in this condition.

Bitcoin volatility

The volatility of cryptocurrencies comes from the fact that these digital coins are limited. For example, there are only 21 million Bitcoin. 80% of these digital coins have already been mined. Thus, there is severe competition over the ownership of the freely available coins.

Trading cryptocurrencies can be very profitable. It requires knowledge, skills and experience. Beginners can invest deftly and experience handsome returns. By understanding the pros and cons of the trade, you can make an informed decision as you enter the exciting world of trading digital currency!